In an era defined by rapid technological advancements, the convergence of FinTech, customer service, and security has become more intertwined than ever before when it comes to customer onboarding. This is where digital onboarding helps businesses like yours to grow and improve. But what exactly is digital onboarding, and why is it pivotal for elevating customer satisfaction?

In this blog, we unravel the significance of digital onboarding and its pivotal role in shaping the future landscape of customer service in Jamaica and the Eastern Caribbean. Additionally, we'll break down the key elements of eKYC (electronic Know Your Customer) and its vital contribution to streamlined processes and enhanced security measures within the Caribbean business environment.

Together we will dive deep into the world of digital onboarding, exploring how it can transform your customer experience. We'll answer questions like:

- What exactly is digital onboarding, and why is it so important?

- How does it improve customer service and satisfaction?

- What's this eKYC thing we keep hearing about, and how does it fit in?

Get ready to unlock the secrets of a smoother, faster, and more secure onboarding process for your customers!

What Is eKYC And Digital Onboarding?

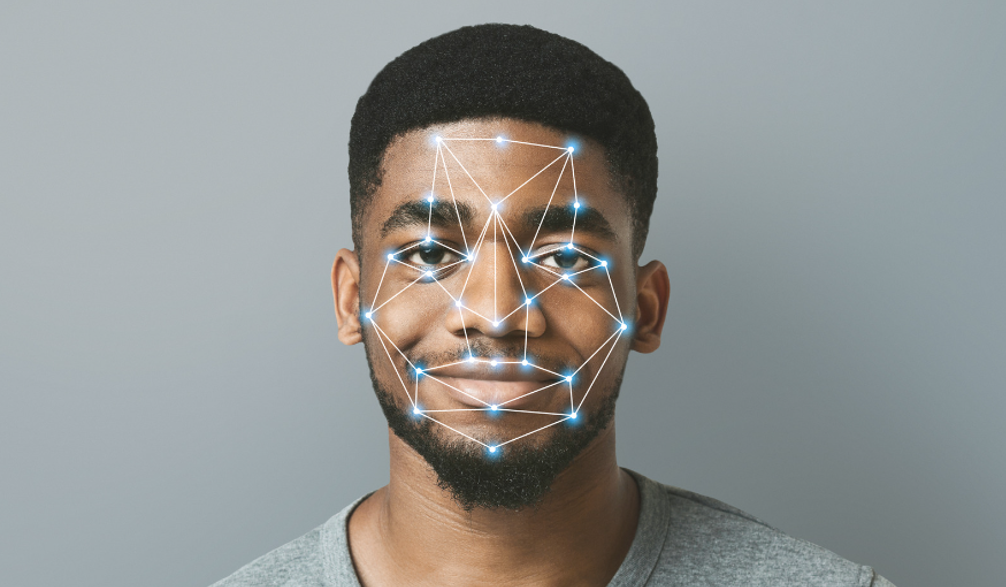

We mentioned eKYC as the solution to our onboarding woes, but what exactly is it? Think of it as a digital version of showing your ID at the airport. eKYC uses secure technologies to verify a customer's identity electronically and allows for online account opening and online payments, all without the need for mountains of paperwork. It's like having a super-powered scanner that checks a customer's info in a flash against a trusted database managed by a credit bureau.

eKYC can be utilized by banking institutions, credit unions, insurance, telecommunications, retail, rentals, real estate, gambling, and hospitality to streamline customer onboarding processes, enhance security, and ensure regulatory compliance.

Challenges Of Onboarding Customers In A Digital Business Landscape

As technological advancements continue to reshape the global business landscape, organizations are confronted with the pressing need to adapt to evolving customer expectations while navigating regulatory requirements. On average 83.75% of the population of the Eastern Caribbean is online with Antigua & Barbuda leading with 95.7%, and Jamaica averaging 82.4%.

Before widespread usage of the internet booking a flight involved a trip to the travel agent, piles of brochures, and enough phone calls to drive you crazy. Now, let's fast forward to today when businesses are still grappling with another kind of manual headache: onboarding customers in a digital age.

Just like booking flights back in the day, not using eKYC involves a whole lot of paperwork, in-person verifications, and more paperwork.

Manual Processes Of Onboarding Customer and KYC

Traditional customer onboarding methods often rely heavily on manual processes, such as paper-based documentation and in-person verification. These methods are not only time-consuming but also prone to errors, leading to delays in the onboarding process and potential frustration for both customers and businesses.

Manually checking paperwork is tedious and time-consuming for everyone involved. Your customers get frustrated waiting, and your team gets bogged down handling mountains of documents. eKYC uses secure technology to verify identities electronically, making it much faster to process and approve applications.

Meeting Compliance Obligations

Financial institutions and other regulated businesses have to follow strict KYC (Know Your Customer) financial system regulations. Without a secure way to verify identities, and avoid money laundering, you risk hefty fines and reputational damage if something goes wrong. eKYC helps you stay on the right side of regulations and avoid any nasty surprises.

Without the robust verification mechanisms provided by eKYC solutions, businesses may struggle to ensure compliance with regulatory requirements, particularly in industries such as finance and telecommunications. Failure to comply with Know Your Customer (KYC) regulations can result in hefty fines and damage to the organization's reputation.

Customer Data Protection and Security

Cyber Security and Customer Data Protection are an increasing concern for customers and businesses in the Caribbean. Countries such as Jamaica and Barbados have implemented Data Protection Acts to regulate the collection, keeping, processing, usage, and dissemination of personal data and to protect the privacy of individuals to their data.

Improving customer service, and experience

A slow and clunky onboarding process is a terrible way to greet new customers. It sets a negative tone for the customer by having a cumbersome onboarding process which can result in a poor customer experience, decreased satisfaction, extended wait periods, and potential abandonment of the onboarding process altogether.

In today's fast-paced digital environment, customers expect seamless and efficient interactions with businesses, making it imperative for organizations to streamline their onboarding procedures. This is evident by Jamaican government officials requesting volunteers for its new National Identification System (NIDS) project resulting in over 300 volunteers within 24 hours. This shows the interest and willingness of Jamaicans to take part in a digital process and streamline their experience.

An eKYC system ensures a smooth and positive first experience, making customers more likely to stick around and also share their experiences.

Reduce onboarding time by 50%

Talk directly to our experts and improve customer experience with secure eKYC. Get Started Now!.

Unlocking Growth for Jamaica and Eastern Caribbean Businesses With Digital Onboarding Benefits

The Caribbean thrives on tourism. However traditional onboarding can be a nightmare for locals and visitors alike. With the Caribbean increasingly becoming a magnet for remote workers and more locals working from home or for international companies, digital onboarding can set your business apart.

New or existing clients can securely submit their information and get verified from anywhere in the world 24/7, even when your brick-and-mortar business is closed at night, on holidays, and on weekends. Whether you are a rental car company, realtor, or financial institution it's a win-win for attracting new customers, decreasing your overhead, and streamlining your application process.

Let's dive in and explore how embracing digital onboarding can unlock opportunities and growth for businesses in Jamaica and the Eastern Caribbean.

Faster Onboarding And Reducing Operational Cost

Paperwork is a time-consuming hassle for everyone. Digital onboarding eliminates the need for manual paperwork and in-person verifications, significantly reducing the time, storage, and resources required to onboard customers. With streamlined processes and automated workflows, your business can accelerate the onboarding journey, allowing for quicker access to products and services.

eKYC streamlines the customer registration process and increases customer satisfaction allowing businesses to onboard new customers in a fraction of the time compared to traditional methods.

This increased efficiency not only improves the customer experience but also enables businesses to focus their resources on core operations, lower operational costs, and increase growth opportunities.

eKYC allows businesses to say goodbye to excessive paperwork and labor-intensive processes. Digital onboarding slashes operational costs by automating repetitive tasks and minimizing the need for physical infrastructure.

Improved Customer Experience and Expand Brand Reach

In a region as diverse and geographically dispersed as Jamaica and the Eastern Caribbean, digital onboarding offers businesses like yours the opportunity to reach a broader audience. By leveraging digital channels, businesses can engage with customers across different locations and demographics, breaking down barriers to entry and fostering inclusivity.

Whether it's reaching underserved communities on your island or tapping into new market segments, digital onboarding opens doors to previously untapped opportunities for growth and expansion.

At the heart of digital onboarding lies the goal of delivering a seamless and frictionless customer experience. By simplifying the onboarding process and minimizing barriers to entry, businesses can enhance customer satisfaction and loyalty by catering to the evolving needs and preferences of customers, fostering long-term relationships, and driving repeat business.

Customer experience is the cornerstone of business success. Digital onboarding delivers a seamless and personalized experience for customers, allowing them to complete the registration process quickly and effortlessly. By removing barriers to entry and providing intuitive user interfaces, businesses can enhance customer satisfaction, foster loyalty, and drive long-term engagement.

Strengthened Security

In an era rife with cyber threats and data breaches, security is non-negotiable. Security breaches are a major concern for any business. Manual onboarding with physical documents leaves you vulnerable to fraud and data destruction. eKYC uses secure technology to verify identities electronically, significantly reducing the risk of fake documents and criminal activity. This keeps your business safe and your customers' data protected.

Also with the rise of digital transactions and online interactions, ensuring the security of customer data is paramount for businesses in Jamaica and the Eastern Caribbean.

Digital onboarding solutions incorporate robust security measures, such as encryption, biometric authentication, and identity verification, to safeguard sensitive information and mitigate the risk of fraud and identity theft.

By instilling trust and confidence in their digital platforms, businesses can foster long-term relationships with customers and uphold their reputation as trusted partners.

Regulatory Compliance and Fraud Prevention

Navigating regulatory requirements and compliance standards is a challenge for businesses operating in Jamaica and the Eastern Caribbean. Digital onboarding solutions are designed to facilitate compliance with Know Your Customer (KYC), Credit Bureaus, and Anti-Money Laundering (AML) regulations and collection to ensure adherence to legal frameworks and upholding industry standards.

By automating compliance processes and maintaining comprehensive audit trails, businesses can mitigate regulatory risks and demonstrate their commitment to upholding the highest standards of integrity and accountability. Human error from your staff and fraud from potential customers is limited with eKYC.

With the rise of digital transactions, businesses face heightened risks of fraud and also requirements of compiling to their countries' regulations. Digital onboarding solutions employ advanced fraud detection algorithms and risk assessment techniques to thwart fraudulent activities before they occur.

By proactively identifying and mitigating potential threats, businesses can safeguard their assets, preserve customer trust, and maintain compliance with regulatory standards.

How Digital Onboarding Fuels Growth

In the bustling markets of Jamaica and the Eastern Caribbean, businesses are on a perpetual quest for growth and expansion. At the heart of this journey lies the pivotal role of digital onboarding – a transformative process that not only accelerates customer acquisition but also paves the way for scalability and sustainable growth. In today’s world, eKYC serves as a catalyst for scaling your business in this dynamic growing region.

Digital onboarding generates valuable data insights that can inform strategic decision-making and optimization efforts. By analyzing key metrics such as conversion rates, drop-off points, and customer demographics, businesses can identify areas for improvement and refine their onboarding processes to enhance scalability and efficiency. This data-driven approach empowers businesses like yours to make informed decisions that drive growth and maximize ROI.

Scaling your business requires more than just ambition – it demands the right tools and strategies. Digital onboarding emerges as a game-changer, offering businesses the scalability, flexibility, and efficiency needed to thrive in a rapidly evolving market. By embracing digital onboarding, businesses can unlock new opportunities, expand their reach, and embark on a journey toward sustainable growth and success.

Ready to simplify your onboarding process?

Ditch the paperwork! Simplify onboarding with eKYC. Fast, secure, and hassle-free. Boost customer satisfaction and gain a competitive edge. Sign up for a free eKYC demo and see the difference for yourself!

Leveraging eKYC and EveryData

In Jamaica and the Eastern Caribbean, digital onboarding isn't just a trend – it's a game-changer. EveryData provides technology that evolves your business and allows you to exceed your customer expectations with our digital onboarding you have a chance to meet those expectations head-on, delivering faster, more efficient processes, enhanced security, and a seamless customer experience.

By leveraging EveryData’s eKYC solutions, businesses can not only streamline compliance efforts but also prevent fraud and safeguard sensitive data. With reduced operational costs and improved scalability, digital onboarding opens doors to growth opportunities that were once out of reach. In this dynamic landscape, embracing digital onboarding isn't just about staying relevant – it's about thriving.

It's about unlocking new possibilities, reaching new customers, and building lasting relationships. So, whether you're a startup looking to make your mark or an established enterprise seeking to innovate, digital onboarding is your ticket to success in Jamaica and the Eastern Caribbean.

Ready to take your business to new heights? It's time to embrace the power of digital onboarding and unlock a world of opportunities for growth and improvement. Get started today and join the ranks of businesses revolutionizing the way they onboard customers and deliver exceptional experiences.

Whether you're a startup looking to establish your presence, or an established enterprise seeking to innovate, EveryData eKYC provides the tools and solutions you need to unlock new possibilities, reach new customers, and build lasting relationships in Jamaica and the Eastern Caribbean.